Lyft has introduced a new type of vesting schedule for employee stock compensation. The crux of it is that it’s a single year vesting schedule that vests 1/4th each quarter. Missing is the one year cliff and the traditional 4 year stock grant plan. Instead when you sign your offer, you get a stock reward amount for that year. After that year, you receive a refresher amount for the next year (which could be lower or higher). Note that Lyft still provides a 'base equity grant' to employees which is a guaranteed minimum amount of stock irrespective of performance. The refreshers added on are what can fluctuate.

Pros

Some of the golden handcuffs are gone now — there’s no 1 year cliff anymore. You can vest in a few quarters and leave a company if you wish. Also, you’re protected from some of the downside. Any declines in stock price over the years would reflect a repriced version the following year. The stock value is in essence closer to cash now. Not sure if this is particular to Lyft, but another plus side may be that because companies have to compensate for the non-guaranteed nature of your stock compensation, they make really compelling offers for your first year.

Cons

This also means that you may not be guaranteed as much (or any) stock the following year. If you do get a refresh the following year, your shares are repriced from the start of that year, meaning you don’t capture as much growth of the company as you would with a 4 year plan locked in from the beginning at a singular price. You lose out on larger appreciations of the stock.

To illustrate this with an example let’s say we join a company using a single year vesting schedule. Let’s assume their stock is priced at $10 / share and I get $1000 worth of stock in the first year, meaning I will get 100 shares. The next year, if the price is $20 / share at $1000 worth of stock, I will now only get 50 shares. In total over the two years, I’d have 150 shares. Whereas if I had a grant for the two years together (typically 4, using 2 for sake of example), and locked in the price at $10 in the beginning, I’d actually have a total of 200 shares!

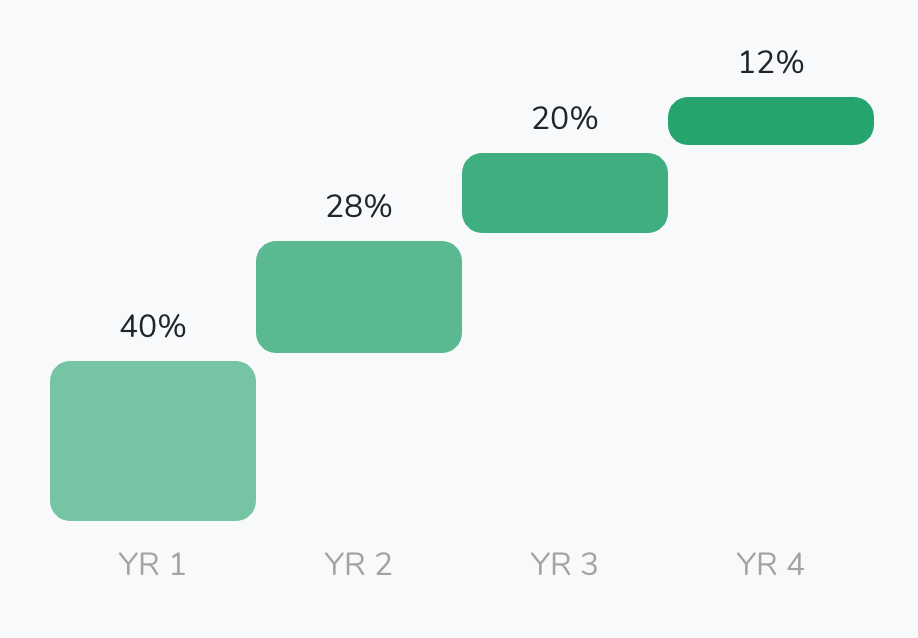

Some other companies have some similar structures as well. Snap and Stripe have both eliminated 1 year cliffs from their offers. Stripe has also introduced a 1 year schedule similar to Lyft. Interestingly, Google has also introduced a much more front-loaded vesting schedule. They are now offering a 40–28–20–12 schedule (sitting in stark contrast to Amazon's back-loaded vesting schedule and although less aggressive, ByteDance's as well).

A new vesting schedule offered to Google employees

Seems like companies are starting to embrace the career liquidity that employees have in the tech industry. They almost expect people to leave after a year or two. But maybe not everyone — perhaps they can now more than compensate employees who are in it for the long term. The most compelling refreshers can now go to the most impactful employees who are interested to stay and see the company grow.

Need help negotiating your package? Get matched with a former tech recruiter to maximize your offer. Book Now